Finding Profitable Edges: How Value Betting Really Works

Value betting is one of the few sustainable strategies in sports wagering. Instead of chasing favorites or betting based on intuition, value bettors focus on price discrepancies. The goal is simple: place bets only when the bookmaker’s odds are higher than the true probability of an outcome. Over time, this mathematical edge can generate consistent profit.

This guide explains how value betting works, how to calculate it, and how to apply it in real betting environments.

What Is Value Betting?

Value betting occurs when the implied probability in the odds is lower than your estimated probability of the event happening.

In simple terms, you are betting when the price is wrong.

For example:

- A bookmaker offers odds of 2.20 (implied probability 45.5%)

- Your analysis suggests the real probability is 50%

That 4.5% gap represents value.

If your probability assessment is accurate over the long term, these small edges accumulate into profit.

Understanding Implied Probability

To spot value, you must convert odds into implied probability.

Formula (decimal odds):

Implied Probability = 1 / Odds

Example:

- Odds: 1.80

- 1 / 1.80 = 0.555 → 55.5%

This means the bookmaker believes the outcome has a 55.5% chance of occurring.

If your research suggests the real chance is 60%, you have found value.

Why Bookmakers Create Mispriced Odds

Odds are not pure probability. They include margin and market influence.

Common reasons mispricing occurs:

- Public bias toward popular teams

- Injury news not fully priced in

- Sharp money entering late

- Emotional overreaction to recent results

Platforms like IviBet and other modern sportsbooks adjust odds quickly, but inefficiencies still appear — especially in smaller leagues or niche markets.

How to Identify Value Opportunities

Finding value requires structured analysis. You need a repeatable method.

Key areas to evaluate:

- Team performance metrics (xG, possession, shot quality)

- Player availability and tactical matchups

- Historical head-to-head data

- Market movement trends

- Motivation factors (tournament stage, relegation battles)

You are not predicting who will win. You are assessing whether the offered odds reflect reality.

Example of a Value Scenario

Suppose:

- A mid-table football team is undervalued after two losses.

- Underlying data shows strong expected goals (xG) numbers.

- The opponent recently overperformed with low-quality chances.

- Bookmaker offers odds of 3.10.

If your model estimates fair odds closer to 2.60, that’s a strong value position.

Types of Markets Suitable for Value Betting

Not all betting markets are equally efficient. The more popular the event, the sharper the pricing.

Markets where value is easier to find:

- Lower division football leagues

- Minor tennis tournaments

- Early opening lines

- Player prop markets

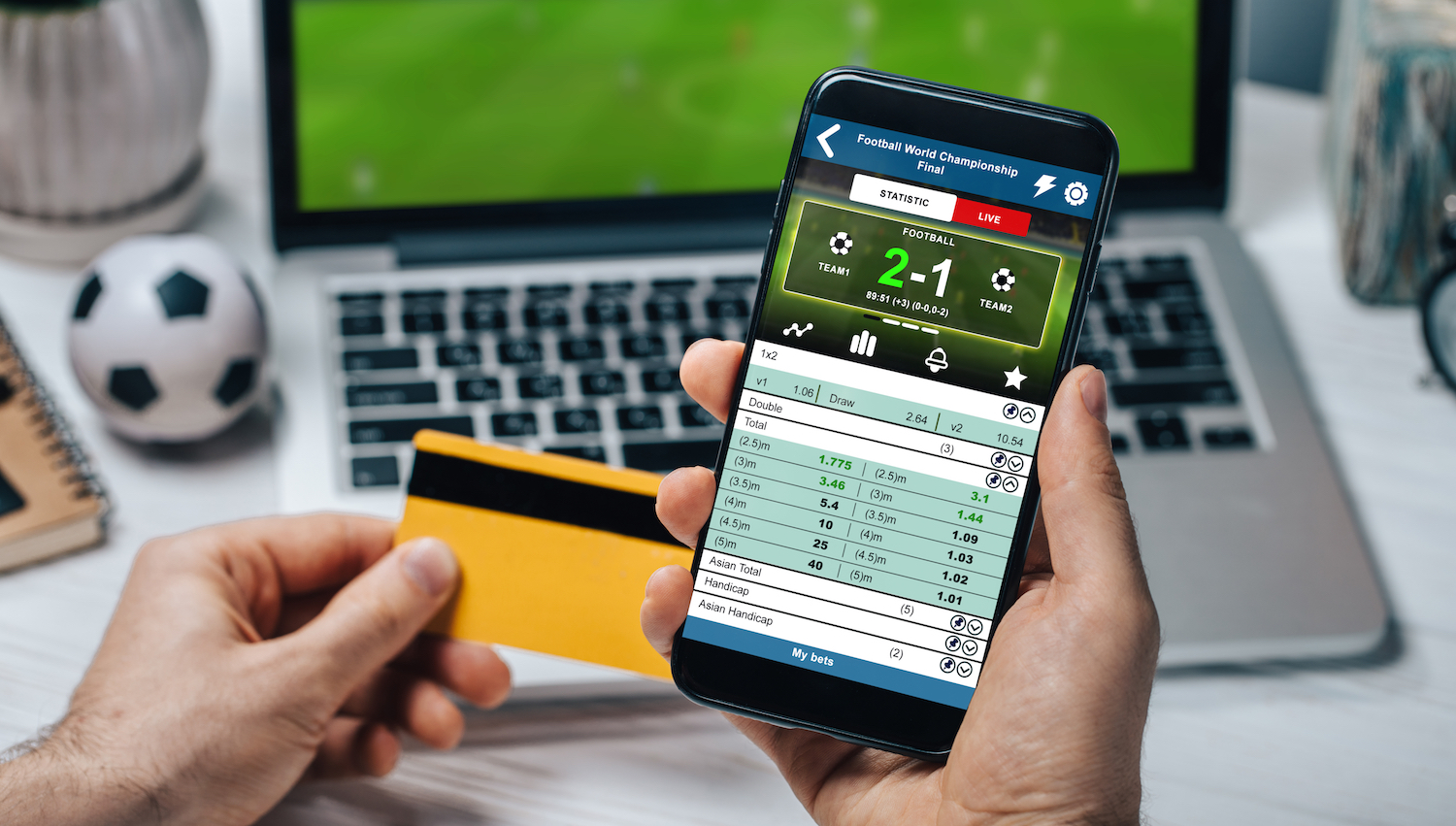

- Live betting after overreactions

Live betting can be particularly profitable if you react faster than the market. For example, a red card may cause dramatic odds swings that are not always proportionally correct.

However, speed and discipline are critical.

Bankroll Management for Value Bettors

Even strong value bets lose frequently. Variance is part of the strategy.

Two core bankroll principles:

- Flat betting (1–2% per wager)

- Kelly Criterion (fractional version recommended)

Flat betting is simpler and safer for most bettors. It protects you from emotional overexposure.

The Kelly Criterion calculates optimal stake size based on edge and odds. However, full Kelly can be aggressive. Many professional bettors use half or quarter Kelly to reduce volatility.

Consistency matters more than short-term wins.

Common Mistakes in Value Betting

Many bettors misunderstand value and sabotage their own strategy.

Avoid these errors:

- Confusing high odds with value

- Ignoring bookmaker margin

- Overestimating personal predictive ability

- Chasing losses

- Betting without a clear probability estimate

Value is not about finding long shots. It is about finding mispriced probabilities.

If you cannot clearly explain why your probability differs from the bookmaker’s, you are likely guessing.

Tracking Results and Closing Line Value

Serious value bettors measure performance beyond wins and losses.

The most important metric is Closing Line Value (CLV).

If you consistently beat the closing odds (meaning your bet was placed at better odds than the final market price), your model likely has an edge.

Example:

- You bet at 2.10

- Closing odds move to 1.95

This indicates the market agreed with your position.

Long-term CLV is one of the strongest indicators of profitable betting skill.

Is Value Betting Sustainable?

Yes — but only with discipline and data.

Professional bettors treat it as an investment process:

- Build statistical models

- Compare multiple bookmakers

- Avoid emotional bias

- Focus on long-term ROI

Sportsbooks monitor consistent winners. If you regularly exploit mispriced lines, limits may be applied. This is why many experienced bettors diversify across platforms such as IviBet and others to maintain flexibility.

Value betting is not glamorous. It requires patience, spreadsheets, and emotional control. But mathematically, it is one of the only approaches that provides a positive expected return over time.

Post Comment